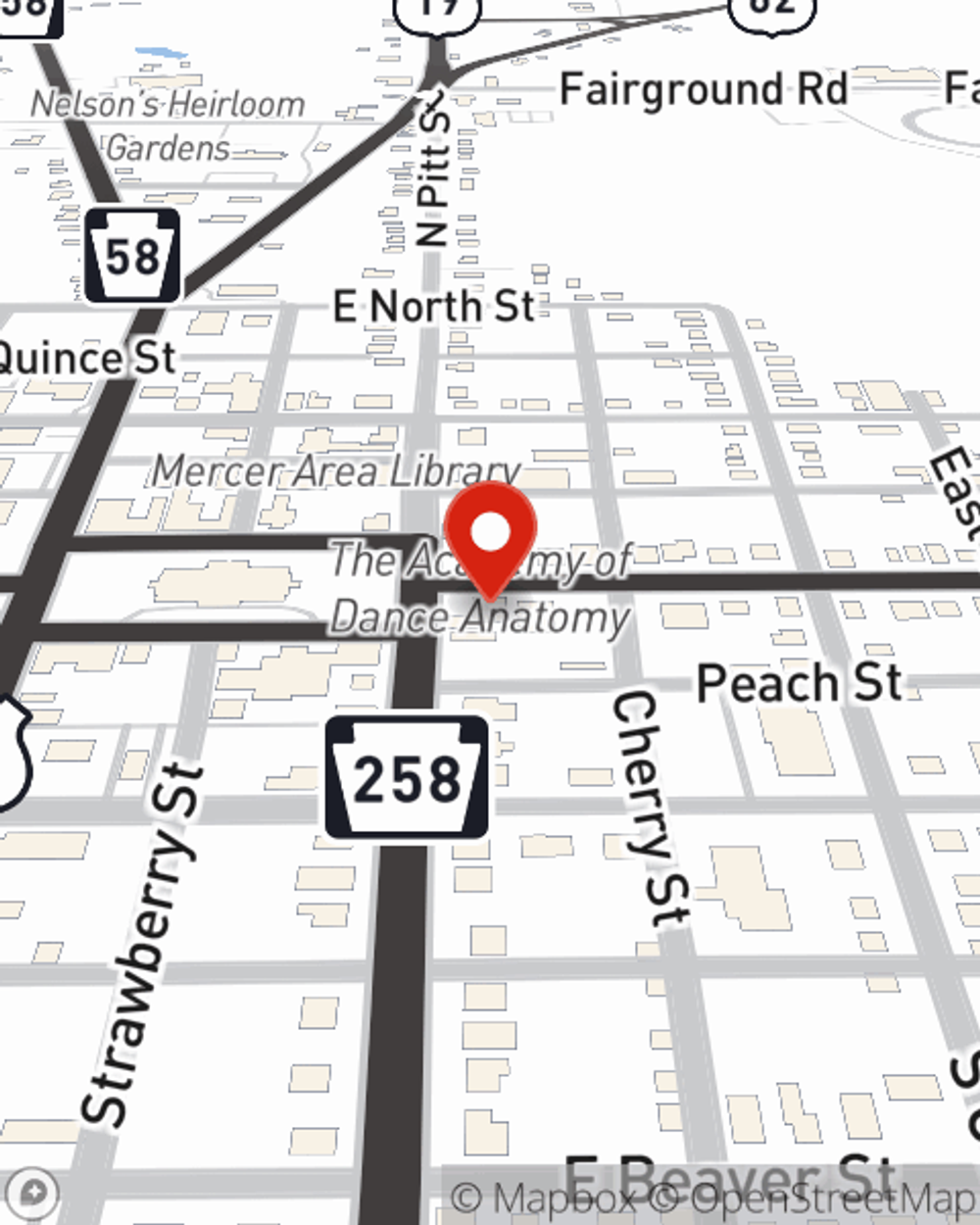

Business Insurance in and around Mercer

One of the top small business insurance companies in Mercer, and beyond.

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for your family. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, a surety or fidelity bond and business continuity plans.

One of the top small business insurance companies in Mercer, and beyond.

Cover all the bases for your small business

Small Business Insurance You Can Count On

Whether you own a pet groomer, a clock shop or a drug store, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by contacting agent Tom Jones's team to explore your options.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Tom Jones

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.